DEER ISLE: Insights, Flows & Investment Trends

Gold Rally, Central Banks and Miners

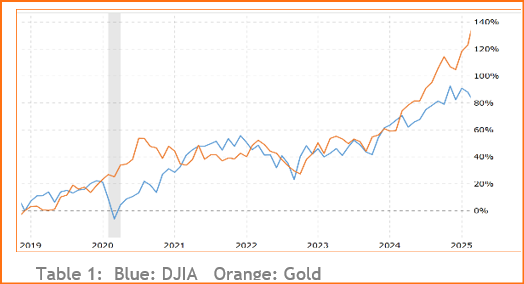

In today’s environment of persistent global volatility, capital is flowing steadily into safe-haven assets — and gold is leading the charge. Since the beginning of 2024, gold has not only appreciated but has significantly outperformed traditional equity benchmarks like the Dow Jones Industrial Average (see Table 1). Notably, the last time we witnessed gold outpacing the DJIA was during the height of the COVID crisis — a reminder of gold’s historic strength in periods of economic dislocation.

This resurgence isn’t just driven by traditional investors seeking protection. Central Banks and major international buyers — many of whom have historically relied on U.S. dollars (USD) and U.S. Treasuries (USTs) — are now actively reallocating into gold. Concerns about USD stability and sovereign debt performance appear to be prompting a strategic shift, giving gold an even firmer foundation for sustained, long-term outperformance.

Consider the following:

- China’s UST holdings have dropped significantly, from a peak of $1.2 trillion in 2015 to just $784 billion as of February 2025 — signaling a broader rebalancing of global reserves.

- The People’s Bank of China (PBoC) has increased its official gold holdings for five consecutive months, adding 2.8 metric tons in March 2025 alone, and posting a net gain of 12.8 metric tons in Q1 2025.

- Central Bank gold purchases rose sharply, with Q4 2024 purchases totaling 333 metric tons, up from 216 metric tons in the same quarter of 2023, according to the World Gold Council.

These dynamics suggest that the bid for gold is no longer simply a cyclical trade — it reflects deeper, structural shifts in global capital allocation.

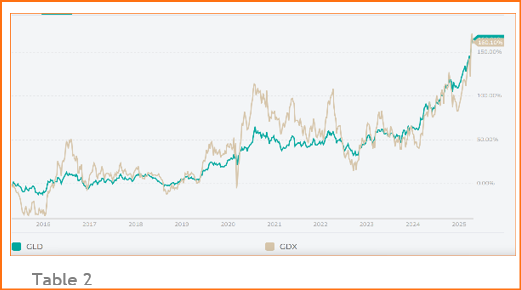

For investors seeking not just protection but enhanced returns, gold mining stocks might present a compelling secondary opportunity. Historically, gold miners have delivered leveraged upside during gold bull markets — typically outperforming the metal itself. Yet as of today, mining stocks have underperformed physical gold (see Table 2), creating what may be an entry point for those looking to position ahead of a potential catch-up rally.

https://portfolioslab.com/tools/stock-comparison/GLD/GDX; https://www.macrotrends.net/2608/gold-price-vs-stock-market-100-year-chart

Capital Provider Interest: LP capital is increasingly shifting toward Europe, driving significant activity focused on identifying managers and analyzing the market landscape. There is particular interest in GPs that offer diversified investment strategies, including country-specific funds. However, these GPs must demonstrate true diversification, such as through investments in companies with substantial international operations.

Private Equity: Limited partners (LPs) are demanding an unusually high level of due diligence from private equity general partners (GPs), particularly regarding the impact of tariffs on portfolio companies. Many GPs are being asked to provide detailed, company-by-company analyses of how tariffs are affecting key operational areas such as product sourcing, sales, and overall operations. Some observers believe that, with LPs making fewer new investments, they now have more bandwidth to devote to ongoing portfolio monitoring and diligence.

Europe: European countries have been announcing that they plan to Increase defense spending to 3 to 4% of GDP which is putting wind into Europe’s growth/tech development and is presenting multiple investment opportunities.

Healthcare: Healthcare valuations are being hit hard with the changing US government spending priorities. Valuations, in some instances, have gone from 2 to 4x revenues to 2 to 4x EBITDA which means significant discounts to prior rounds.