DEER ISLE Insights, Flows & Investment Trends

Infrastructure Success & Bottlenecks

The US Government has made and continues to make billions of dollars investment into Clean Energy and other infrastructure developments. This money was a large part of the discussion at the recent SelectUSA FDI conference where over 9 State Governors spoke about the programs that their states are implementing to attract investment and jobs. As this government money rolls out, it requires private capital investment which means that “infrastructure” is likely to be a next big wave of private fund investment focus given returns can be risk managed by the government grants.

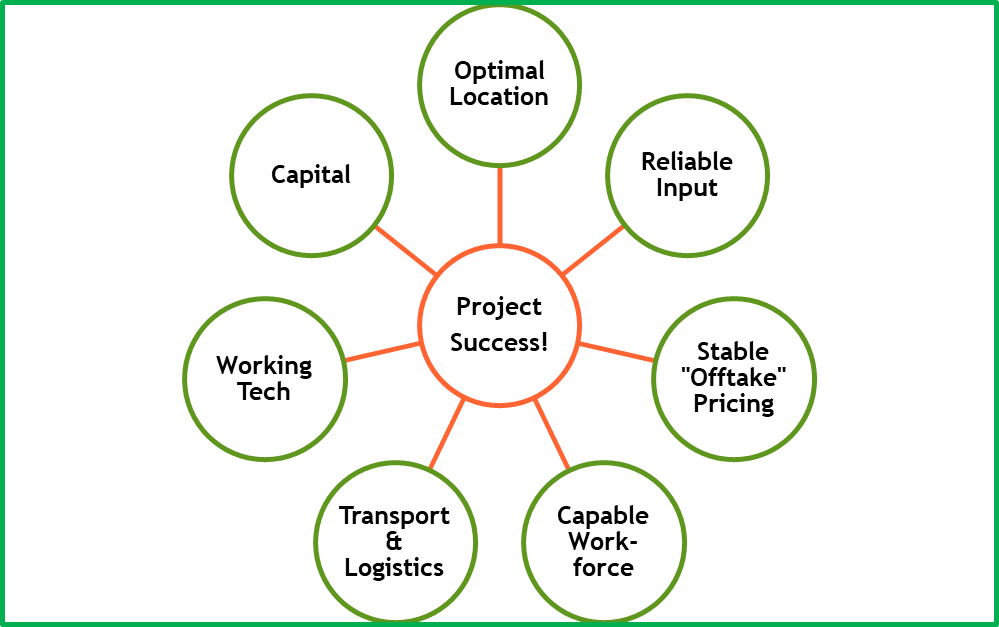

Infrastructure success, given the required size and impact, is dependent upon getting many factors right and it is difficult to have impact and success without success on each factor. Complicating investment prospects is that each factor is multifaceted and requires significant infrastructure of its own. For example, if a solar farm replaces a coal plant in a rural area, there needs to be a workforce that can work at the solar plant as well as technology access for the solar plant to be successful.

Based upon the discussions at SelectUSA, the state governors and other government officials understand these requirements. Therefore, much of the discussion at SelectUSA was on how each state was working to put into place the required foundational factors for successful implementation of large-scale infrastructure projects.

Capital Provider Interest: Credit Provider to sponsors or minority recaps – usually in a uni-tranche structure with 15 to 20% non-control equity participation. Targeting $5 to 15mm of EBITDA and will consider smaller businesses that are doing roll ups. Lending $10 to 30mm and can do larger amounts within a club structure.

Real Estate Credit: Large RE Private Credit players are having a hard time “putting capital to work” given equity conditions. There are enough transactions in the market but interestingly since the RE Private Credit lenders require higher amounts of equity (20% or so) and there is not enough interested equity to support the lenders’ requirements, transactions are not clearing.

China: A recent JPM central banker conference disclosed that JPM asset management has reduced their China exposure to essentially 0 as well as, based upon a survey of JPM clients, most asset managers have also reduced their exposure to essentially 0, or significantly reduced their exposure. There are a small percentage who have only slightly reduced their exposure. If the Chinese government can convince international markets that there is no fear of reprisal and money can flow in/out of the country – there seems to be upside given potential capital flows.

Venture Capital: Many Venture Companies want “Venture Debt” in these market conditions since they believe that equity is too costly. However, Venture Debt providers usually want 18%+ return with a senior position on revenue. This seems like a very high cost of capital that rivals the cost of equity, however equity is junior in the capital structure. A decision as to whether this provides the best source of funding needs to be carefully assessed.

Sponsors: See Real Estate Credit above. We are seeing multiple Sponsor transactions failing to close given lender requirements on either equity amounts or terms.