GUEST POST: SALE or CAPITAL RAISE TIMELINE: 3 Months to Close

A Capital Seeker’s understanding of the financial due diligence timeline can significantly help them prepare for a sale or capital raise. By becoming familiar with the timeline, they gain key insights on how to create efficiencies, develop an understanding of the data requirements and deliverables, and start to visualize the impact of the transaction. As well, it helps key stakeholders, including management, investors, and potential buyers anticipate milestones or roadblocks, so you can allocate resources effectively and ensure a smooth transaction process.

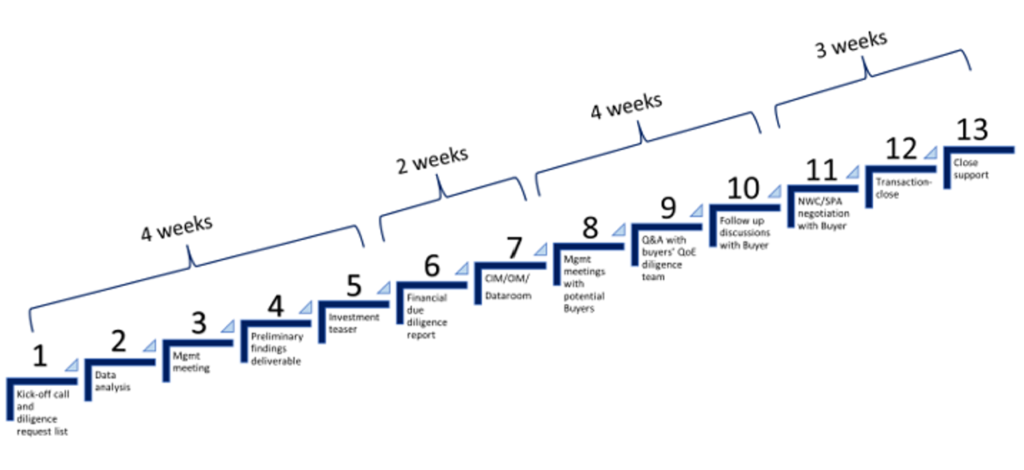

The timeline included below is for illustrative purposes and may vary based on the complexity of the transaction.

ILLUSTRATIVE SELL SIDE FINANCIAL DUE DILIGENCE PROCESS TIMELINE

| Weeks 1-4 | Capital Seeker’s usually engage a sell-side diligence team, who will conduct preliminary discussions with management, analyzes financial data, and prepares a preliminary findings deliverable. Simultaneously, your investment advisor may create an investment teaser for external parties. |

| Weeks 5-6 | A due diligence deliverable is shared with the seller and selected potential buyers, along with a confidential information memorandum. |

| Weeks 7-10 | Involves management meetings with potential buyers, and detailed discussions between buyers and the sell-side diligence team. By involving a sell-side diligence team, it streamlines the due diligence process and reduces management’s burden in explaining financial information. |

| Weeks 11-13 | The sell-side diligence team assists the seller in negotiating the net working capital target and financial information related terms outlined in the purchase agreement. As well, they provide support for any ad-hoc analysis required to help the seller close the transaction. |

The finance and accounting experts at CFGI have extensive experience performing sell-side due diligence and helping organizations make financial decisions that put them on a track to lasting success.

If you’d like additional information on sell-side due diligence, accounting/close support, or have questions and thoughts to share, please email pwilliams@cfgi.com, nparikh@cfgi.com and tmenscher@cfgi.com