TIME IS DUE DILIGENCE: Use it to Your Capital Raising Advantage

Capital Seeker:

“I am not going to waste my time on them. I sent an email, had a call and/or meeting on my investment opportunity. There has been no follow up”. Many Capital Seekers

Capital Provider:

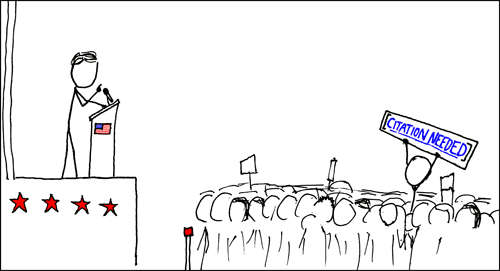

“The point is the opportunity might be a good one, but the pitch is awful. Would you walk up to someone on the street and say, Hi, would you like to invest in my company?”

Be thoughtful. Build a relationship. Don’t be that person.”1 Quote from Sr Managing Director at Lone Pine on LinkedIn

The gap between these two statements is realizing that “time is due diligence””.

Time closes this gap when a Capital Seeker understands that a capital raise includes its active development of potential Capital Providers. A Capital Seeker should expect to provide meaningful updates, research, webinars, and other materials to all potential Capital Providers who could be interested in an opportunity (rather than none or a small set). A broad base of interested Capital Providers will help ensure that there are always interested Capital Providers when there is a capital opportunity.

- Time is part of capital markets due diligence. A due diligence process takes time.

- Time helps develop personal or virtual relationships. These are a required part of a successful due diligence process.

- Time is required to build a successful brand. A successful brand can reduce due diligence requirements.

TIME AS PART OF CAPITAL MARKETS DUE DILIGENCE: Confirmatory due diligence is usually happening as time passes. There is nothing like time to confirm the investment thesis including investment milestones, team dynamics and success metrics.

TIME HELPS DEVELOP PERSONAL OR VIRTUAL RELATIONSHIPS: Relationships take time to develop. Institutional Capital Providers usually want a relationship with private market Capital Seekers.

Relationships can be personal which are few since personal relationships take one on one time. Personal relationships are important to a private market capital raise process and often initial capital comes from these personal relationships. However, especially in competitive investment environments, there are often not enough personal relationships to obtain best outcomes.

Relationships can also be virtual. Virtual relationships are developed using a robust investor relations process which takes time and enables a broad base of relationship. Public companies and large funds use a continuous process of active investor relations to develop a broad base of institutional relationships. They do not have personal relationships with every institutional investor in their potential capital market. Those with best investor relations usually obtain most capital and have best valuations.

TIME IS REQUIRED TO BUILD A SUCCESSFUL BRAND: Virtual relationships and active investor relations also help build brand recognition. Time spent building brand is time well spent. One constant across all products (everything from grocery store purchases, to buying automobiles, to monetizing TikTok posts, to raising capital) is that brand matters. Those companies and funds with best brand recognition usually get best outcomes in their capital raises.

When a Capital Seeker uses time to their advantage, then they are best positioned to raise not only for current capital needs but also for future capital requirements. Since growing organizations typically require capital over time – time spent focused on today’s capital needs that also build a foundation for future needs is usually well rewarded.