DEFY THE NUMBERS: Capital Landscape by the Data

| It Will Get Better! |

Private equity and venture capital markets are navigating a stark new reality. After years of abundant capital, fundraising has not only slowed — it’s been in systemic decline. The global contraction is impacting transactions of all sizes, particularly emerging and sub-$1B managers, and the downstream effects are evident across deal flow, valuations, and investor behavior. Amid this contraction, a singular sector — AI — is absorbing a disproportionate share of capital, leaving the rest to fight harder for every dollar.

A Multi-Year Fundraising Decline Is Now Reshaping the Market

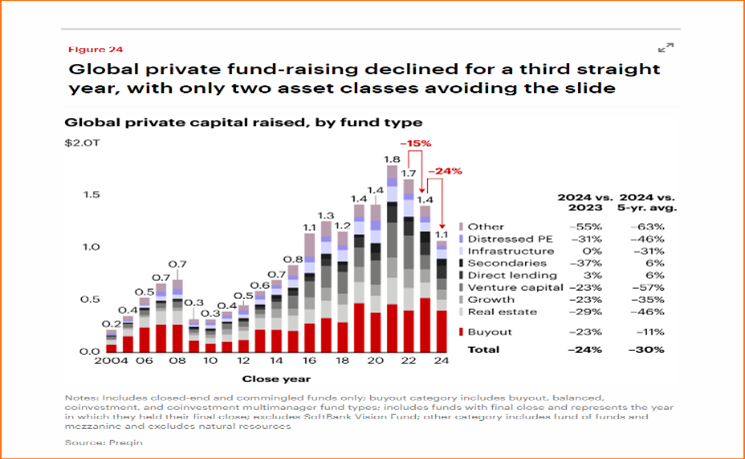

According to Bain & Company’s Private Equity Outlook 2025, total global private capital raised fell 24% in 2024, marking the third consecutive year of decline.

Private Equity Outlook 2025: Is a Recovery Starting to Take Shape? | Bain & Company

U.S. Private Equity Market Recap – March 2025 | Insights | Ropes & Gray LLP

As shown, buyouts, venture capital, and growth equity all saw major fundraising declines. The few bright spots — direct lending and secondaries — are largely driven by niche mandates.

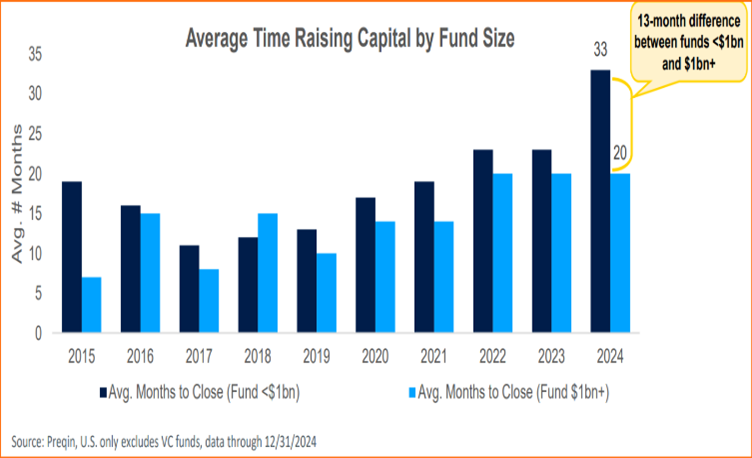

The challenge is compounded by extended fund capital raise timelines. For instance, fund raising timelines for private equity funds have increased to 33 months for funds with less than $1 billion of assets under management and to 20 months for private equity funds with assets greater than $1 billion of assets under management.

Deal Activity Has Slowed Across the Board — Except for AI

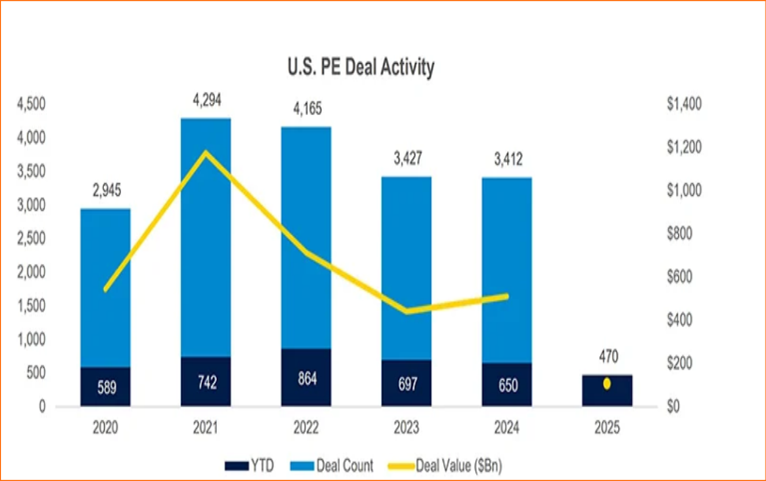

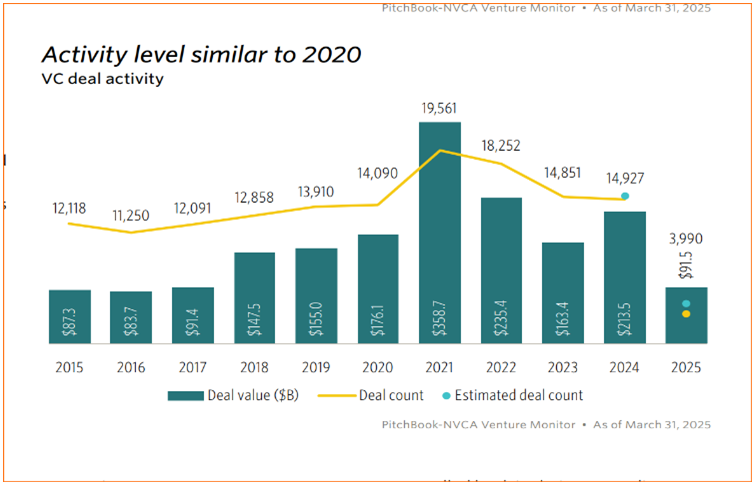

The slowdown in fund capital raising is cascading into the dealmaking landscape, as is demonstrated by the slowdown in deal volume and value since 2021. Part of the slowdown is certainly due to valuation mismatches, so deals cannot be transacted, but even with over $1 trillion in “dry powder”, GPs feel that they have limited liquidity to put to work. In the PE space specifically, we are on track to see the lowest deal activity in five years. And, VC activity has similarly receded to 2020 levels, both in terms of count and deal value.

https://www.ropesgray.com/en/insights/alerts/2025/03/us-pe-market-recap

https://nvca.org/wp-content/uploads/2025/04/Q1-2025-PitchBook-NVCA-Venture-Monitor-19001.pdf

AI Is the Outlier: A Concentration of Capital

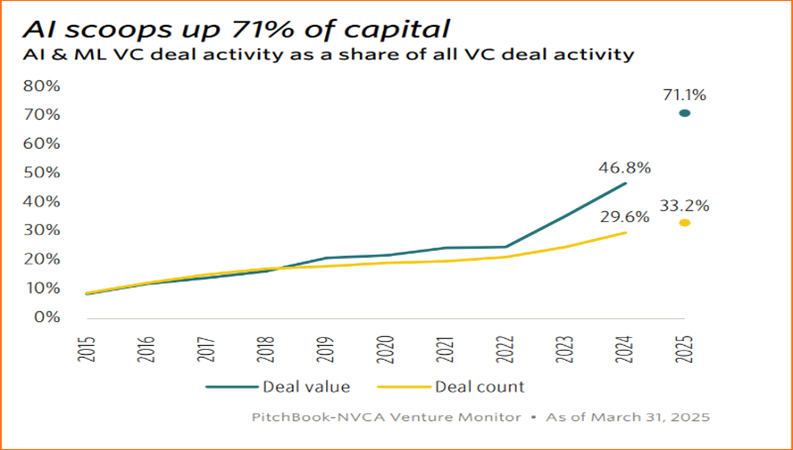

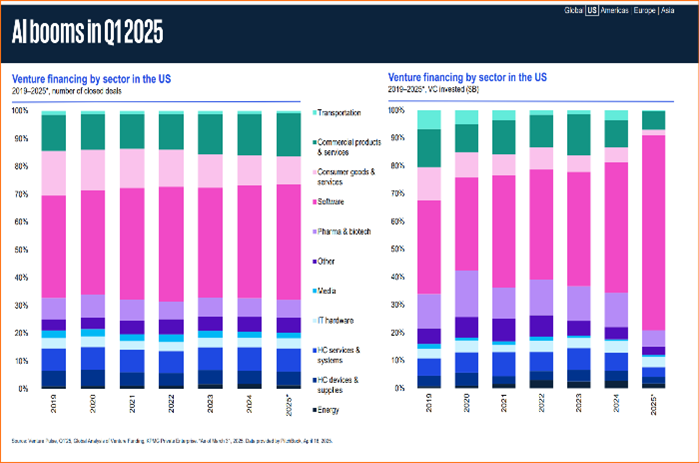

Amid this contraction, AI is an outlier. In Q1 2025 alone, AI accounted for 71% of all VC deal value: Deal value in “software” has significantly increased in share since 2021, with deal count rising as well — though at a slower rate — suggesting larger checks for fewer companies (see table below). Other sectors are being increasingly overshadowed.

The implications are clear for non-AI Capital Seekers. Capital is scarcer, rounds are smaller, and valuations are more conservative. While AI companies may enjoy up-rounds and mega-deals, most startups are facing flat or down rounds, and median deal sizes have shrunk across nearly every stage.

https://nvca.org/wp-content/uploads/2025/04/Q1-2025-PitchBook-NVCA-Venture-Monitor-19001.pdf

Fundraising Best Practices Are Now Mandatory

To raise capital in this market Capital Seekers, which include GPs as well as Company Executives and Founders, need to have a disciplined approach and follow capital raising best practices.

| Fundraising Process | Key Practices |

| Preparation Must Be Institutional | Transform business strategy into an investment opportunity Develop institutional-quality materials, including clear narratives and defensible financials. Ensure strong, supported alignment between the vision and execution strategy. |

| Long-Term Engagement & Momentum Building | Build warm Capital Provider relationships over time. Leverage technology to increase breadth and depth of engagement. Use strategic and consistent updates to maintain investor interest and build trust. |

| Closing Discipline | Employ strong close tactics: soft circles, urgency timelines, phased closes. Treat closing as an active, managed process — not a passive outcome. Use structuring techniques to bridge valuation and other gaps that might arise between Capital Providers and Capital Seekers. |

In today’s bifurcated capital markets, only those who adopt a professional fundraising process, which are the tactics used by the larger, more successful Capital Seekers, will succeed. Capital is still being deployed — just more selectively, more slowly, and with higher expectations. Use capital raising best practices and be selected!