NAVIGATING DIVERSE CAPITAL TYPES: Clarity and Transparency Helps

“We Only Want Value-Add Capital”

When companies raise capital, they often attract a variety of capital types, including for direct transactions, private equity (PE) firms, strategic investors (Strategics), high-net-worth individuals (HNWs), and venture capital (VC) funds as well as, for fund investments, traditional institutional investors (including pensions, endowments, foundations), multi and single-family offices and, increasingly, high net worth.

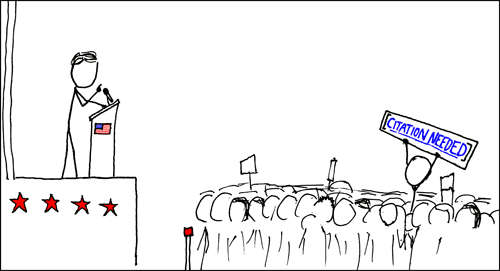

Diverse investor types can bring complementary strengths to a company, such as capital, expertise, and market access and multiple types might be considered “value-add capital”. However, managing these relationships effectively requires proactive measures to align expectations and mitigate conflicts.

Key Steps for Success in managing these important relationships:

- Establish clear agreements on time horizons, risk tolerance, and governance roles.

- Foster open communication to bridge cultural and strategic divides.

- Build governance structures that balance influence and decision-making authority.

- Plan exit strategies early, with mechanisms to accommodate different priorities.

This table highlights some of the specific risks and solutions.

| Capital Considerations | Risks | Solution |

| Time Horizon | Misaligned time horizons can create tensions over decision-making, reinvestment, and exit strategies. E.G. Institutional capital in a fund might prefer long lockups while HNW wants short term liquidity. | Establish clear, upfront agreements about timelines, including buy-sell clauses or staggered exit provisions that accommodate differing objectives. |

| Strategic Goals | Strategic conflicts can emerge when financial and operational goals diverge, leading to disputes over business priorities. E.G. PE might want to focus on operational efficiency while Strategics might want high growth. | Develop a shared business plan that identifies overlapping interests and aligns operational goals, ensuring that governance structures address potential conflicts. |

| Governance | Governance conflicts can lead to decision-making bottlenecks and diluted leadership authority. E.G. PE and VC might demand board seats while HNW has a personal interest in specific decisions. | Clarify governance rules, establish balanced representation, and designate decision-making powers to avoid gridlock. Independent board members can act as mediators in disputes |

| Risk Tolerance | Differing attitudes toward risk can result in friction regarding growth strategies, reinvestment decisions, and diversification efforts. E.G. Institutional capital might desire low volatility as a co-investor while the PE sponsor does not mind high volatility in the context of their fund. | Create risk management frameworks that balance aggressive growth opportunities with safeguards for risk-averse stakeholders |

| Exit Strategies | Exit misalignment can derail deals and create delays that harm valuations. E.G. Family office might prefer never to exit while VC wants a quick exit. | Implement contractual mechanisms, such as drag-along and tag-along rights, to ensure smoother exit processes. Consider phased exits to balance stakeholder needs. |

| Culture | Differing styles of communication and decision-making can lead to misunderstandings and decreased cohesion. E.G. One PE may have a consensus culture while another has a “every person out for themselves” culture. | Foster a culture of transparency and regular communication. Implement standard processes for meetings, updates, and decision-making to bridge cultural divides. |

By addressing these challenges strategically, companies can harness the benefits of diverse capital while mitigating risks that could jeopardize their success.

If you would like advice on how to align a diverse capital base especially if there are tough upcoming decisions – Contact us!