PRIVATE WEALTH ADVISOR & PRIVATE MARKET PRODUCTS: 5 Diligence Questions

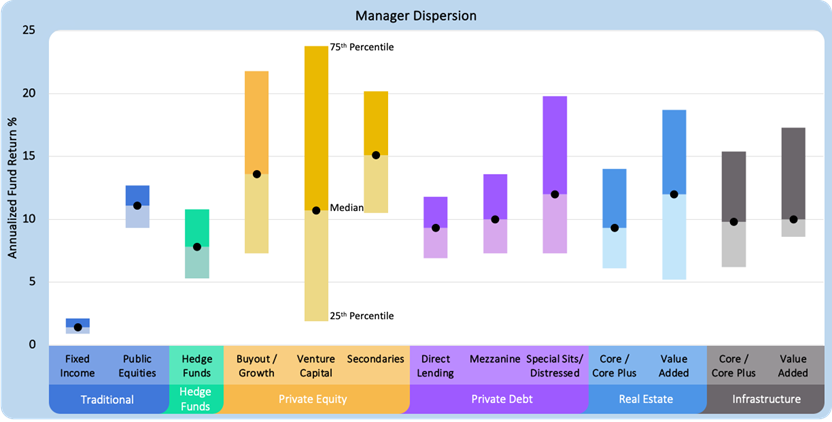

It is a cliché at this point, but manager selection matters. In the public markets, manager dispersion is relatively narrow compared to the private markets (see below), and while poor manager selection can be costly, capital can be reallocated quickly given the liquidity. In the private markets, the interquartile range between managers can exceed 500 basis points in private credit and 1200 basis points in private equity. These spreads are much wider than in public markets. In structures with limited liquidity and long lockups, poor selection is more challenging to fix (especially if everyone is doing it at the same time), which is why manager selection should be performed by a private markets specialist that acts as a fiduciary and puts investors first.

Source: CAIS, Assessing the Persistence of Private Equity Performance, August 11, 2023.

Given these performance spreads, the following diligence questions are designed to help you navigate manager selection and appreciate the importance of investment structure, as well as dig into the meat of a private market offering and assess whether it is worth deeper consideration and your clients’ long-term capital commitment. They are meant to surface structural or strategic mismatches, as well as give investors a few questions to push managers on regarding any existing track record and what it means prior to investing.

| Key Questions | Why It Matters |

| Does the strategy match your client’s risk profile and time horizon? | From an investor’s perspective, equity is equity in both the public and private markets – it should be used for long-term growth and inflation protection. Fixed income (aka credit/debt) too serves the same purpose in the public markets as it does in the private markets – capital preservation and current income. In contrast to private credit’s ability to target short-duration loans and offer more flexible liquidity, private equity often requires multi-year holding periods to unlock value, with no guaranteed interim cash flows. If your client needs liquidity and is uncomfortable with capital lockups, the private market mismatch can be problematic. |

| Does the vehicle structure match the underlying strategy? | Not all strategies belong in all wrappers. Strategies with long-term value creation (e.g., PE or opportunistic real estate) are poor fits for interval funds offering quarterly liquidity. Tender offer funds may be a better fit, but offer less liquidity. Even secondaries or cash-flowing strategies require careful review. Just because a product offers liquidity does not mean the underlying assets can support it consistently. |

| Are the managers aligned with investor capital and disciplined around risk? | Are the managers invested alongside investors? Look for meaningful manager (GP) commitments, not symbolic ones. More importantly, how focused are they on the downside or are they taking excess risk with Other People’s Money (OPM). Is there unnecessary risk with investor capital to chase incentives that are disconnected from long-term outcomes? |

| What does the track record really show? Especially during challenging periods? | Ask where things have gone wrong and what changed. A top-quartile return may hide blowups, bad exits, or inconsistent process. Too often, one or two successful investments can drive a portfolio’s return. The key is not just understanding performance, but repeatability. How has the team evolved? What risks do they now manage differently? |

| Does the investment add true value to the client’s portfolio? | Adding another “alternative” does not automatically mean diversification. Make sure the return drivers, liquidity profile, and exposure correlations complement, not replicate, what is already in place. Understand what will be displaced and whether the trade-off makes sense. |

Conclusion. Broadly speaking, private wealth advisors are in the first inning of becoming saturated by private market products. Given the level of private wealth sales and product team buildouts across asset managers, there is so much more to come. As an advisor, some of the questions above can be quickly answered and applied to opportunities being presented, while a couple others can help you dig deeper and develop a better understanding of what the managers actually do. Use them to help decide if a product fits your clients’ needs before making an investment. On the surface, it may appear that yield, access, and liquidity are enough, but to be successful, strategy, structure, and manager behavior must be aligned.